If budgeting doesn't excite you, you're doing it wrong

Budgeting should be exciting. This article explains why tech workers should work towards their goals by using a budget strategically, not simply restricting spending.

Many tech workers are skeptical about setting up a personal budget, but that's because they have the wrong type of budgeting in mind.

The Scarcity Budget is what immediately comes to mind when you think of budgeting. It works by creating spending restrictions and then rigidly enforcing them. It's inflexible and time-consuming to maintain, leading to exasperation after you inevitably fail to live up to your "perfectly planned" budget.

Compounding the problem, tech workers tend to see budgets in extremes: either completely refusing to introspect about spending or obsessively tracking every single cent for no apparent purpose.

The Strategic Budget flips the script: it recognizes spending as a resource, not a vice. Then, it encourages the budgeter to make conscious trade-offs about their spending to ensure it aligns with their values and long-term goals. This could mean spending less, spending more, or simply spending on different things.

Without any budget, you run the risk of misallocating your money towards things you don't care about, only to find out you don't have enough to afford something truly significant to you.

A budget can help you:

- Discover where to spend more and where to cut back (to achieve your goals faster)

- Decide whether to work more or work less (to improve your quality of life)

- Splurge and treat yourself in a way that you won't regret later.

- Run experiments on your spending to increase your life satisfaction

- Time-travel your money by deciding whether to invest for later or borrow for now

This series of three posts will explain why budgeting is a practical tool, not just a chain and shackles in spreadsheet form, and provides a quick primer for setting a budget up.

The Budget Series

- Part 1: Why tech workers should have personal budgets (this post)

- Part 2: How to start your strategic budget

- Part 3: Running budget experiments

- Part 4: Refining your priorities (Coming soon)

Follow me on Twitter or sign up for the email newsletter to be notified when part 4 becomes available.

Why tech workers should have personal budgets

The Scarcity Budget

First, let's try to rid you of any aversion to budgeting you may have previously acquired.

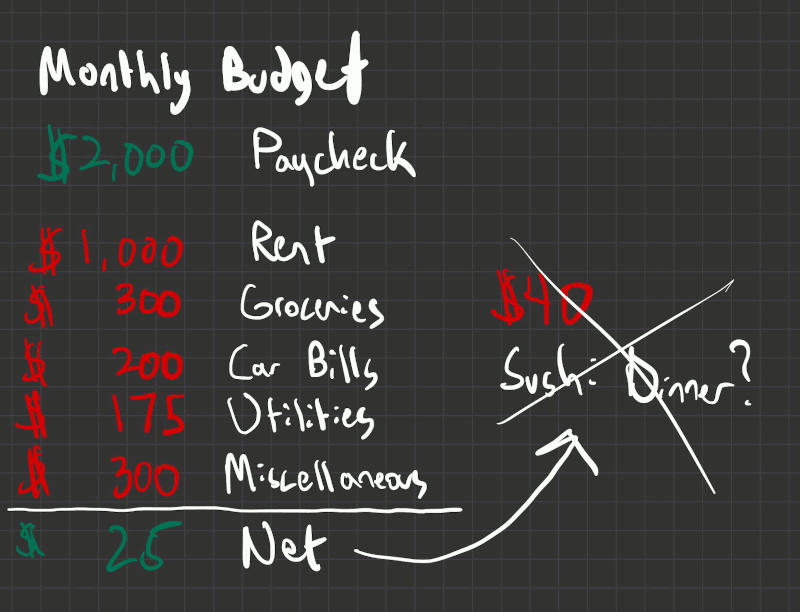

The common conception of a budget that makes people frustrated and angry is what I call The Scarcity Budget. The idea for this budget is to set up a bunch of restrictions on your spending at the beginning of the month and rigidly stick to them to make sure you have enough money left at the end.

With this method, first, you keep track of all your financial transactions (in an app, checkbook, or with a bunch of envelopes of cash). Then you continually slap yourself on the wrist when you want to do something that isn't in your budget.

When you are considering going out with your friends to try the new sushi place that opened, you end up choosing between two sad options:

- Eating a Lean Cuisine by yourself on a Friday night and feeling depressed

- Going out with your friends and having fun, but later feeling frustrated that you broke your own rules and this whole budgeting thing isn't working out

The point of The Scarcity Budget is to ensure you don't run out of money. You deprive yourself of the things you want today based on the limitations you set up at the beginning of the month.

For some in difficult financial situations, this could be an essential first step. Many don't have a sushi dinner to spare and live paycheck-to-paycheck or are buried in debt. The first rule of not being broke is not to spend more than you make. Stringent budgeting could be one of the only ways to climb out of that hole.

However, for the vast majority of tech workers (and anyone with a bit of slack), this short-term and inflexible sort of budgeting is grating and not particularly useful.

When you're just learning to drive, contemplating every touch of the gas pedal and turn of the steering wheel can be helpful. But when you're making a cross-country road trip, scrutinizing every move like that is excruciating. It's also not a particularly safe way to drive or the best way to handle any problems that come up unexpectedly.

Tech workers who have enough income to support their immediate needs will find The Strategic Budget much more helpful (and more fun to think about!) than a Scarcity Budget.

The Strategic Budget

The Strategic Budget is not about setting limits on your spending, but it instead flips the script:

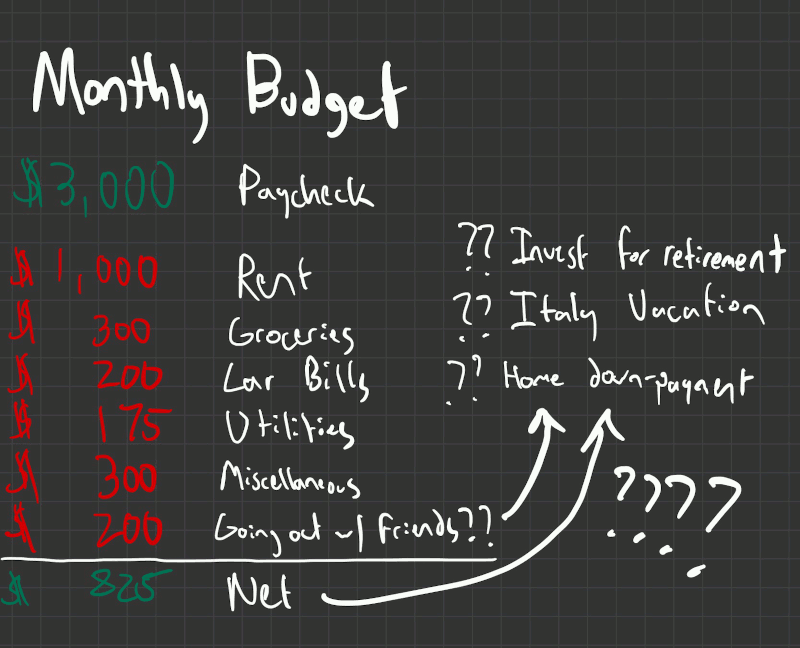

How can you configure your spending so that it accomplishes as much as possible for you?

Maybe you want to buy the perfect home for your family. Maybe you want to look more stylish or fit. Maybe you have a passion for creating music and want to pursue that. Maybe you want to spend more time out on a lake sailing. Maybe you want to devote your life to improving the environment.

Heck, I don't know you! But if you have a tech income, you likely can already afford many of the things you want. The question is -- which things should you buy now? You couldn't possibly decide whether it makes sense to buy that new guitar to pursue your musical passion without some system to figure out what you're trading off.

So the point of The Strategic Budget is not to prevent you from spending. Instead, it provides a framework to force you to confront the spending trade-offs you're making and ensure alignment with your goals and values. And to do it quickly and guilt-free.

Just writing down your financial situation with your personal goals and contentment in mind can be clarifying. In the simplified example above, the budgeter might ask themselves:

- Is taking the Italian vacation they've always wanted or saving for a home more important?

- Is the $200/month car-lease leading to as much joy as the $200/month going to dinner with friends?

- What's in the miscellaneous category anyway? Can it be cut down to start saving for retirement?

These trade-offs are usually not directly addressed without a budget and continually gnaw at the back of the mind. Budgeting resolves the tension. If a $200/month car markedly improves your daily commute, you shouldn't feel guilty about it! And if it's not meaningful to you, you should stop paying as much for it.

Strategic Budgets are not fixed in stone, and it's healthy to experiment regularly:

- How would the budgeter feel if they started an Italian vacation fund by cutting their dinner-with-friends budget in half for one month?

- What if they had dinner with friends a couple more times in a month by buying cheaper groceries?

These are not high-stakes decisions. But if one of the experiments works, then over time, it could add up to stronger relationships with friends, a home purchased a couple of years earlier, or the Italian dream vacation.

So a Strategic Budget is less like a set of personal laws punishable by guilt and more like a lighthouse used to orient your spending as you navigate life. You check in periodically -- Am I headed in the right direction? Is my money still being deployed in the best possible way to support my long-term goals and short-term happiness?

How to start

Hopefully, this article made budgeting seem a little more meaningful, or at least less unpleasant! In the following article, I'll go into a little more detail about the steps I recommend to set up your own budget.

Key takeaways:

-

Most people think of budgeting as an authoritarian process to restrict spending, but tech workers should use a more strategic type of budgeting

-

Strategic budgeting focuses less on staying under budget and more on determining what your money can accomplish for you

-

Setting a budget will force you to confront the trade-offs of your spending decisions, ensuring alignment with your goals and values